Metaverse Tokens Outperform Cryptoverse Amid Broader Decline

UpOnly | Research #14: Metaverse gains, Axie’s continued decline, and bullish hires dominate play-to-earn sector

Rescinded job offers at Coinbase. Layoffs at Gemini. Talks of a prolonged crypto winter are dominating news headlines as startups and investors aggressively downsize exposure to the space. Amid the decline, the GameFi and Metaverse space has held up well, hinting at significant returns when market sentiment flips.

The latest edition of UpOnly | Research reviews recent data indicating that Metaverse and GameFi-related tokens have vastly outperformed the rest of the crypto market. We also consider revenue data related to play-to-earn pioneer Axie Infinity and bullish hires at Nakamoto Games that indicate the play-to-earn space can weather a prolonged crypto winter.

Metaverse tokens are up 400% amid a broader market decline

Since hitting nearly $3 trillion in November 2020, cryptocurrency market capitalization has slumped by over 60%. The current value stands at $1.2 trillion, with leading cryptocurrency Bitcoin struggling to hold above $30,000.

(Source: CoinMarketCap)

Amid the current market decline, new research published by Kraken Intelligence reveals that the Metaverse and GameFi sector has significantly outperformed the rest of the cryptoverse. The gaming sector is one of the only two sectors in crypto still posting positive returns on the year-on-year chart (YoY), thanks to massive price jumps recorded last year at the peak of the bull run. The DeFi space has performed the worst, with a 75% decline on the yearly chart.

(Source: Kraken Intelligence)

Coins and tokens covered under Kraken’s Metaverse category include majors such as Decentraland (MANA) and The Sandbox (SAND), as well as newcomers like Apecoin (APE) and STEPN (GMT). The Metaverse space posted the highest volatility across the crypto space, with over 170% swings in the period under consideration.

The high volatility is a reminder of the industry’s nascent nature. It can also be considered evidence that any huge returns potentially lie in long-term exposure as the Metaverse movement is yet to enter the mainstream adoption phase.

Axie Infinity’s struggles continue as revenue hits fresh lows

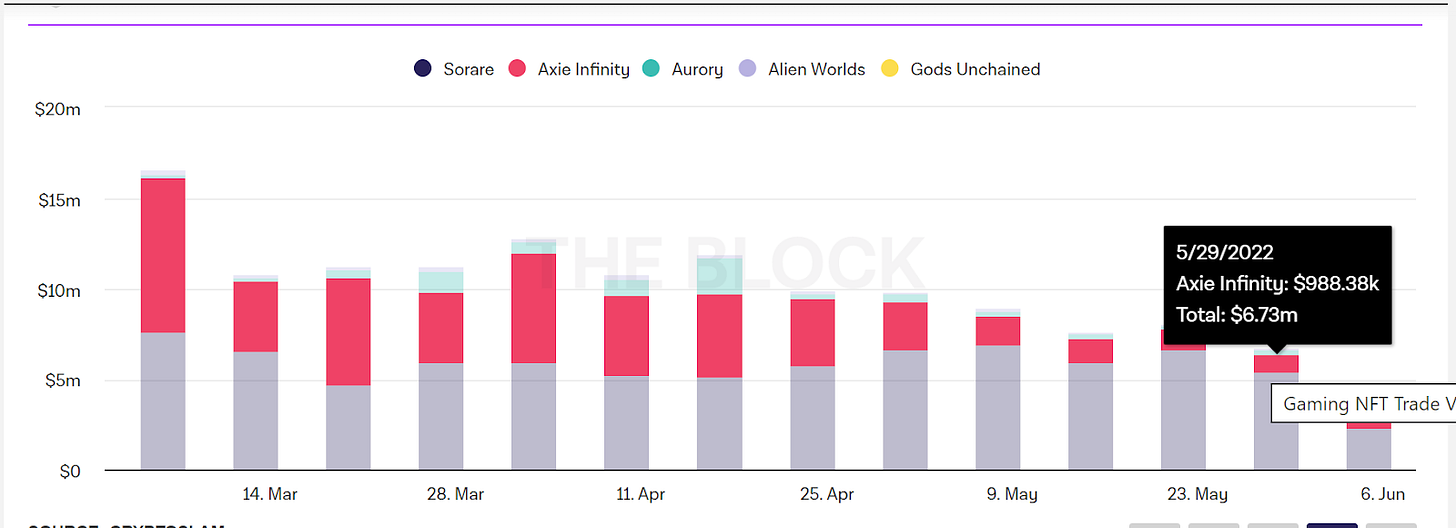

Play-to-earn pioneer Axie Infinity failed to earn $1 million in weekly revenue for the first time in over a year. According to data from The Block, Axie Infinity only pulled in $988,400 in revenue in the week between May 29 and June 5, 2022. The fresh low is another worrying statistic from an ecosystem that was once a model for upcoming play-to-earn games.

(Source: The Block)

At its peak in August 2021, Axie Infinity raked in $251 million in revenue within a week, and was on track to hit 3 million registered players. However, the rise was soon marred by poor tokenomics, a crypto bear market, and an infamous $600 million hack (the largest in crypto history). Ongoing efforts to revitalize the Axie Infinity ecosystem, including new game releases and improved tokenomics, have failed to yield the desired results.

Will Axie Infinity ever recover its lost glory? Investors betting on a potential recovery are betting on Axie Infinity's position as the first play-to-earn game to reach mainstream players. Other incentives such as onboarding community-created gaming experiences might also help Axie Infinity.

Nakamoto Games intensify hiring as CEO allays bear market fears

Play-to-earn gaming ecosystem Nakamoto Games has quickly burst onto the blockchain gaming scene, launching several gaming titles and onboarding over 100,000 users within less than six months. The robust user growth and expansion plans mean the startup is not slowing down on hires despite the current market conditions.

Nakamoto Games CEO Chawalit Rugsasri recently noted that the platform has been rapidly expanding its workforce and is poised to bring in new talent over the coming months. A follow-up announcement confirmed that Nakamoto Games is finely placed to bailout and acquire “top-tier gaming projects” that struggle with financing during the anticipated bear market. If any such acquisition materializes, it will undoubtedly strengthen Nakamoto Games’ foothold in the industry and help bolster adoption.

A key takeaway from the recent development around Nakamoto Games is for investors to prioritize backing play-to-earn and Metaverse startups projects with the capacity to weather a long winter. Blockchain gaming undoubtedly holds immense potential that will be unlocked by projects that keep building irrespective of market drawdowns.

UpOnly’s week in brief

About UpOnly

UpOnly is a first-of-its-kind data directory dedicated to providing insightful and actionable data on the move-to-earn, play-to-earn, and Metaverse gaming fields. Our solution addresses a market that is left largely uncovered by other data providers and we aim to become a one-stop shop for gamers worldwide to identify the most lucrative play-to-earn and optimize their performance within these gamers. Alongside our data directory, we will launch a decentralized predictions platform that will allow anyone globally to bet on the outcome of play-to-earn and Metaverse gaming events.