Why Smart Money is Backing the Metaverse

UpOnly | Research #41: Institutional investment firms ramp up Metaverse interest

The Metaverse is perhaps the most exciting market in the world in terms of growth, technological innovation, and the promise it holds in the future. So much buzz surrounds this evolving concept; the word itself placed second in the Oxford University Press 2022 word of the year. According to research by the university, the usage of the word increased fourfold in 2022.

The relevance of the Metaverse has been reflected in every tier of society, from the establishment of million-dollar funds in large investment institutions to the public opinion of the everyday consumer. In this edition of UpOnly | Research, we demonstrate that recent interest from worldwide investment funds is merited due to a wave of freshly published studies and surveys. These studies predict a paradigm shift in technology habits in both businesses and consumers in the near future.

Smart money leads the way

Smart money refers to money that is invested by professionals. Smart money has a higher success rate as institutional investors tend to have better investment strategies and more information than the average retail investor.

BlackRock is the largest and arguably the most successful group of institutional investors of all time. Their recent interest in the Metaverse is a sign of promise for the market..

Blackrock launched a Metaverse ETF, currently listed on the European stock exchange Euronext. It tracks the STOXX Global Metaverse Index, which identifies 65 market-leading Metaverse companies in digital marketing, gaming, healthcare, manufacturing, software, and hardware.

The index relies on robust methodology, selecting the top 10% of Metaverse platforms based on high-quality patents in next-gen innovations. These innovations can range from 3D image modeling, blockchain, and NFTs to virtual, augmented, and extended reality.

Omar Moufti, product strategist for ETFs at BlackRock, said: “We see the Metaverse as the next leap forward in global communication and connectivity. It has the potential to revolutionize many sectors and processes, and reshape every facet of society, from the way we work, consume, interact, and produce.”

BlackRock is just one of the global investment firms making moves in the industry. AXA IM hired a new face to co-manage their recently launched Metaverse investment fund, which currently sits at $31 million.

The new fund was launched earlier this year to invest in companies that play a part in the blending of the digital and physical world. The multi-cap fund invests in long-term Metaverse opportunities in developed and emerging markets worldwide.

AXA IM’s strategy for this new fund will focus on four core themes: gaming, socializing, working, and enabling. Enabling is further subdivided into tech infrastructure, cyber security, and payment. Out of the hundreds of Metaverse stocks available, the company has selected 60 to add to its fund.

Mark Hargraves, head of AXA IM equity, said, “The Metaverse is an expanding and tangible investment opportunity, driven by real companies with the potential to deliver strong year-on-year growth over the next decade. With a global customer base, we expect to see an increasing number of companies emerging from new sectors to bolster the promising investment opportunities in this space.”

Institutional Investment reflects public opinion

Institutional investor confidence is driven by companies and individuals adopting various elements of the Metaverse. A recent study by Tenable demonstrated just how important Metaverse development is to the future of global business, and that future is not as far away as many would think.

The company surveyed 1,500 respondents, all IT, cybersecurity, and DevOps professionals working for companies based in Australia, the UK, and the US. They found that 64% of Australian businesses plan to invest in the Metaverse in the next 6 to 12 months. The survey also revealed that 56% of U.S. and 55% of U.K. businesses expect to do the same.

There were some concerns about the societal shift towards the Metaverse. 44% of respondents said managing cybersecurity risk was the most salient threat to their organization. 38% said privacy concerns and information collection were paramount in considering the digital transition. The respondents recognize that a proactive strategy will be necessary to enable organizations to operate in the new virtual world.

That's not all. In a separate survey of 2,000 employees and 400 leaders conducted by Meta in the US and the UK, it was found that 76% of employees said they were keen to incorporate virtual reality into their working lives. They cited better collaboration, work-life balance, and togetherness as key drivers for this belief.

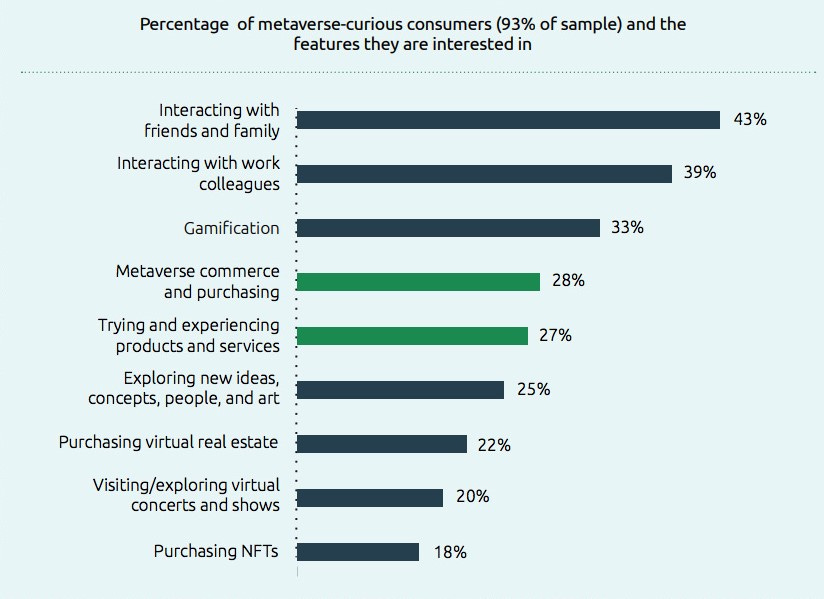

This paradigm shift goes right to the top, from the everyday consumer to the largest investment firms in the world. A recent survey of 8,000 consumers revealed that over 93% are curious about the Metaverse, citing interaction with loved ones, colleagues, and games as the key reasons for their curiosity.

(Source: Capgemini)

The world is beginning to accept change

Change is universally difficult. According to the structural inertia theory, organizations are limited in their capacity to adapt because they facilitate highly reproducible behaviors and reward stability. However, the utility of the Metaverse is too great to ignore, and businesses and consumers are beginning to accept it as an inevitable societal change.

Institutional investors have recognized the potential of widespread adoption and the technology's possibilities in business and entertainment. They have established investment funds and stock options to cater to the thriving Metaverse market. These are likely the first of many funds that will be set up in a market projected to be worth over $600 billion by 2030.

UpOnly awaits the wave of traditional gamers

A telling statistic from the evidence presented is that 33% of consumers surveyed are curious about the gaming element in the Metaverse. Considering there are nearly 3 billion gamers worldwide, this isn’t surprising. As the Metaverse becomes more widespread, so will platforms that offer both Metaverse and gaming elements. UpOnly has a wide variety of projects that fit the bill within our data directory. These are accompanied by insightful statistics that will guide users in maximizing their profits from gaming and investing, opening them up to a new frontier of entertainment. Check out UpOnly to begin your data-driven GameFi and Metaverse journey.

This week in UpOnly

About UpOnly

UpOnly is a first-of-its-kind data directory providing insightful and actionable data on the play-to-earn and Metaverse markets. Our solution addresses a market left largely uncovered by other data providers. UpOnly aims to become a one-stop shop for gamers and investors worldwide. It specializes in assisting users in identifying the most lucrative play-to-earn games and optimizing their investment performance within the industry. Alongside the data directory, UpOnly has launched a decentralized predictions platform and is on the verge of debuting a range of other blockchain-based services, each one a key ingredient to building an all-encompassing web3 platform.